Why Mature Risk Assessments Are the Secret to Cyber Resilience

A Deep Dive for CISOs, GRC Leaders, and Enterprise Risk Teams

According to Deloitte’s 2024 Cyber Resilience Report, organizations with mature risk assessment programs are 40% more likely to withstand cyberattacks and 60% more likely to recover quickly from them.

This isn’t a coincidence. It’s a reflection of design: resilience isn’t reactive—it’s constructed through deliberate, intelligence-driven risk architecture.

Mature assessments aren’t merely diagnostic—they’re strategic, predictive, and operational. They form the spine of modern cyber governance.

Why This Matters

Cybersecurity isn’t just growing more complex. It’s accelerating in a way that most organizations—technologically, operationally, and culturally—are not prepared to match.

Consider a standard enterprise setting today:

New SaaS applications are introduced weekly, often without formal IT vetting or governance.

Third-party integrations—from CRMs to billing processors—are expanding your threat surface exponentially.

Attackers have scaled up, now armed with AI-driven malware, zero-day exploit markets, and nation-state resources.

Regulators have shifted posture—expecting not just controls, but governance. They want to see evidence of risk comprehension at the board level.

It’s no longer viable to treat risk assessment as a static annual exercise. In this landscape, mature risk assessments are not checklists—they’re living systems. They guide strategic priorities, validate investments, and, when done right, serve as a real-time map of your organization’s exposure, resilience, and accountability.

Understanding Risk Assessment Maturity

At its core, risk assessment maturity refers to the extent to which an organization can accurately identify, contextualize, quantify, and prioritize cyber threats—and how well it can connect those threats to business impact.

A mature program does not treat risk as a technical issue buried in the security team. It operates at the convergence of IT, legal, operations, finance, and governance. Maturity, in this sense, is integration—not just across systems, but across leadership.

What Maturity Actually Looks Like

Risk maturity is often measured across five levels, progressing from ad-hoc, compliance-driven efforts to dynamic, intelligence-fed systems that drive decision-making at the highest levels.

While many organizations operate around Level 2 or 3 (periodic assessments, siloed reporting), the goal is to reach Level 5—where assessments are continuous, data-backed, and woven into strategic and operational workflows.

At this level, risk is no longer an abstract concept or a regulatory requirement. It becomes a business asset—providing insight, justifying investment, and guiding resilient architecture.

The Regulatory Imperative: Why Risk Maturity Is Now a Mandate

In 2023 and 2024, we’ve seen a definitive shift in regulatory expectations. Authorities no longer accept vague claims of cybersecurity readiness or blanket policies. They are demanding real-time accountability, board visibility, and evidentiary governance.

SEC Cybersecurity Disclosure Rules (2023–2024)

Public companies are now required to disclose material cyber incidents within four business days, a move that forces organizations to rethink how they track, measure, and report risk.

More importantly, annual 10-K filings must now include:

Descriptions of cybersecurity governance processes

Management’s role in assessing and managing risk

The board’s oversight of cyber threats

This is not merely an exercise in documentation. It's a paradigm shift. CISOs and risk leaders must now demonstrate that risk identification is not confined to a security silo—but that it’s embedded into operations and reviewed at the highest levels of oversight.

EU Digital Operational Resilience Act (DORA)

DORA takes a similarly aggressive stance—requiring financial institutions and ICT providers to perform continuous risk assessments, implement resilience testing, and maintain oversight over their third-party providers.

The language of DORA makes it clear: risk is not a snapshot. It’s a dynamic operational competency. Risk maturity under DORA must be demonstrable through automation, documentation, and constant refinement.

Deep Dive: Components of a Mature Risk Assessment Program

A mature risk assessment program is not a one-time project or a static document—it’s a living system. It’s continuously updated with real-time threat intelligence, tightly aligned to business operations, and built to deliver actionable outcomes for GRC, security, and executive stakeholders.

In this section, we’ll break down the five foundational components of mature risk assessments—not as checklist items, but as interconnected pillars that evolve together.

1. Dynamic Threat Modeling

Purpose: Move beyond theoretical vulnerabilities to understand how actual adversaries could impact your environment, based on your specific assets, architecture, and business commitments.

Traditional risk assessments often focus on internal weaknesses in isolation—missing the broader attack chain. Dynamic threat modeling shifts this approach by simulating how threat actors behave in real environments, chaining tactics together to achieve real-world objectives.

What it looks like in practice:

Threat modeling is performed using frameworks such as MITRE ATT&CK, FS-ISAC threat intelligence, and CISA’s Known Exploited Vulnerabilities (KEV) list to map relevant TTPs (Tactics, Techniques, and Procedures).

Simulations are built using Breach and Attack Simulation (BAS) platforms (e.g., AttackIQ, SafeBreach, Picus Security) to validate how existing controls perform against adversary behavior.

The modeling is contextualized to critical business services—so the output is not just “X asset is vulnerable,” but “Y business process is at risk of disruption or data compromise.”

🔐 Real-World Deep Dive: Threat Modeling in a SaaS HR/Payroll Platform

Let’s consider a cloud-based HR and payroll SaaS provider, which serves mid-market and enterprise clients. It manages sensitive financial data, provides high-availability services, and operates under regulatory scrutiny from frameworks like SOX, GLBA, and CCPA.

The threat modeling exercise focuses on adversary behavior rather than hypothetical weaknesses. Here’s how it unfolds:

Step 1: Define Business Context and Critical Assets

Crown Jewel Assets:

Payroll data (SSNs, salaries, banking info)

Administrative portal (high-privilege configuration)

OAuth connections to third-party systems (NetSuite, QuickBooks)

Business Commitments:

SLA: 99.99% uptime for payroll delivery

Compliance scope: GLBA, SOX, CCPA

Contractual penalties: up to $250,000 per client for breach or SLA failure

Step 2: Integrate Threat Frameworks

MITRE ATT&CK (Cloud Matrix): Provides behavioral mapping for likely cloud-based attacks

CISA KEV: Identifies vulnerabilities with known exploit activity

FS-ISAC: Feeds real-world financial sector intelligence into prioritization

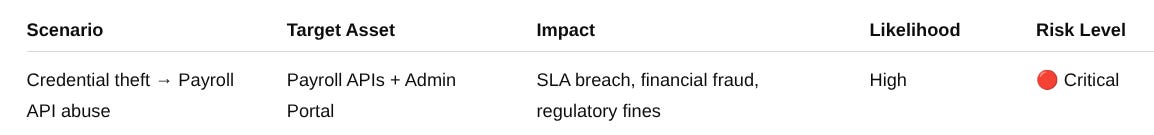

Step 3: Build Threat Scenarios Using TTPs

Here, TTPs are mapped into a likely attack chain:

Step 4: Leverage BAS Tools for Validation

Platforms like AttackIQ and SafeBreach are used to simulate this kill chain in the environment, testing not just detection, but actual control efficacy—do the IAM rules block lateral movement? Is MFA enforced on all admin endpoints? Are anomalies in direct deposit changes logged and flagged?

Step 5: Risk Output Summary

Executive Risk Alignment

Key Deliverables

A threat landscape map with real-world attack paths and affected assets

A business-aligned mitigation roadmap, ordered by operational and compliance risk

An evidence package for internal audit, with logs, simulations, and detections

An executive summary linking the threat to potential revenue, trust, and legal impacts

✳ Why it matters: This use case illustrates how dynamic threat modeling transforms a risk assessment from a static document into a strategic artifact. One that security, risk, and finance teams can all rally around—because it shows how risk manifests, what it costs, and how to mitigate it with business intelligence in mind.

2. Risk Quantification Models

Purpose: Transform qualitative guesswork into decision-ready, financially grounded insight.

While many risk programs still rely on red-yellow-green heatmaps to communicate risk severity, these color-coded abstractions fall short when explaining risk to executive leadership. They lack the clarity, defensibility, and precision that boards and CFOs demand.

A mature risk program replaces gut-feel severity ratings with quantified financial models—anchored in data, historical incidents, and business input. This is where methodologies like FAIR (Factor Analysis of Information Risk) come into play.

What this looks like in practice:

Loss Event Frequency (LEF): How often a given threat scenario is expected to occur, based on threat intel and internal trends.

Probable Loss Magnitude (PLM): The estimated financial impact if the event occurs—factoring in downtime, SLA penalties, legal exposure, reputational damage, and customer churn.

Annualized Loss Expectancy (ALE): The calculated risk in dollars per year, combining frequency and magnitude.

This shift enables organizations to move from vague concerns like “ransomware is a top threat” to concrete, data-driven conclusions like:

“A ransomware incident targeting our SaaS environment is expected to cost $367,500 annually if not mitigated.”

🎯 SaaS Environment Example: Quantifying Ransomware Risk with FAIR

Imagine a SaaS company offering a collaboration platform used by enterprise clients. One critical risk identified during the assessment phase is a ransomware attack targeting the customer database hosted in AWS.

Here’s how FAIR methodology brings clarity:

1. Identify the Risk Scenario

“Ransomware infection leads to encryption of production environment, causing a 3-day outage.”

2. Estimate Loss Event Frequency (LEF)

Based on industry data and past events, estimate the likelihood at 0.5/year (once every two years)

3. Estimate Probable Loss Magnitude (PLM)

4. Calculate ALE (Annualized Loss Expectancy)

0.5 × $735,000 = $367,500/year

Strategic Decision-Making Enabled by Quantification

The security team presents two mitigation options:

The CFO and CISO now have a clear justification: investing in both mitigation and insurance brings risk below the organization’s acceptable threshold ($100,000/year), with a documented ROI.

Key Output

A quantified risk register that enables risk comparisons across business units and geographies

Clear prioritization of remediation efforts, based on risk-adjusted cost-benefit analysis

Board-level summaries that translate cyber risk into business language: impact on revenue, customer retention, and financial exposure

✳ Why it matters: Quantification doesn’t just enhance credibility—it creates alignment. It bridges the language gap between cybersecurity and finance, transforming risk conversations from “what if?” to “how much, how likely, and how can we reduce it efficiently?”

3. Third-Party & Supply Chain Risk Mapping

Purpose: Expand the risk lens beyond internal assets to account for external vendors, platforms, and outsourced services that are integral to operations—but often outside direct control.

Most modern organizations rely on dozens (if not hundreds) of third-party providers—from cloud infrastructure to HR platforms, payment processors, marketing tech, and analytics tools. Each one introduces a unique threat vector. The problem? Many organizations have limited visibility into their third-party ecosystem, let alone fourth-party or sub-processor exposure.

What this looks like in practice:

Comprehensive vendor inventory: Every third-party relationship is cataloged with details on data access, service dependencies, and business function alignment.

Risk tiering: Vendors are categorized as critical, high, medium, or low based on:

Sensitivity of data handled

Level of network/system access

Regulatory impact (e.g., GLBA, HIPAA, GDPR exposure)

Due diligence integrations: Security questionnaires, SOC 2/ISO attestations, and contractual clauses (e.g., Data Processing Agreements, SLAs, incident response obligations)

Contextual overlays: Considerations like data residency laws, geopolitical tensions (e.g., vendors operating in sanctioned or unstable regions), and fourth-party disclosures.

Maturity in Action

Let’s say a fintech company identifies that 40% of its mission-critical data flows pass through just two cloud service providers and one payment gateway API.

If one provider is based in a region now facing EU-US data transfer scrutiny (due to Schrems II or evolving GDPR rules), that dependency becomes not just operational risk, but legal risk.

Further investigation reveals that the payment gateway uses a sub-processor located in a region under active cyber sanctions, heightening the need for enhanced monitoring or termination of service.

Key Output

A live third-party risk matrix feeding directly into vendor onboarding, procurement controls, and incident response planning

Risk flags for concentration (too much reliance on one vendor), country-level exposure, or weak contractual protections

Better alignment between Legal, Procurement, Security, and Compliance—ensuring that vendor risk is managed at the speed of business

✳ Why it matters: Your risk surface is no longer bounded by your firewall. Third-party risk is now first-party risk—and it requires just as much structure, ownership, and oversight as anything built in-house.

4. Business Impact Mapping

Purpose: Connect technical cyber risk to strategic business priorities—so leadership understands what’s truly at stake.

Too often, security teams focus on technical vulnerabilities (e.g., CVEs, misconfigurations, missing patches) without clearly articulating how those issues translate into business disruption. This creates a communication gap between cybersecurity and the C-suite—where the real decisions about risk tolerance, investment, and response are made.

Mature risk programs bridge this gap by explicitly mapping cyber threats to the business processes, revenue streams, and customer commitments they could impact. In doing so, they elevate cyber risk from a security issue to a strategic concern.

What this looks like in practice:

Business process mapping: Identify how data, systems, and teams contribute to core revenue-generating or customer-facing activities.

For example, understanding that your cloud billing engine doesn’t just process payments—it directly supports monthly revenue recognition and contractual SLAs.

Dependency analysis: Determine which applications, APIs, and infrastructure components underpin those business processes.

Impact scoring: Use input from Business Continuity Planning (BCP), Disaster Recovery (DR), SLA requirements, and regulatory obligations to assign business impact ratings to different risk scenarios.

Strategic Use Case

Let’s say a global e-commerce company maps a particular risk:

“Denial of service attack disrupts payment processing API for 2 hours.”

A technical assessment might classify this as a medium-severity availability risk. But when aligned with business context, it’s clear that the incident could cause:

$400,000 in lost revenue/hour during peak season

Breach of uptime SLA with payment partners

Reputational damage among top-tier merchant accounts

Potential non-compliance with PCI DSS reporting windows

That same risk, seen through the business lens, is now a high-priority scenario—and justifiably requires mitigation investment.

Key Output

Executive dashboards that reflect cyber risk in business terms: “$X impact if Y system fails due to Z threat”

Prioritized risk scenarios that align with strategic goals: growth, M&A readiness, compliance, uptime, trust

Decision-support reports that enable leadership to confidently allocate resources, accept residual risk, or demand stronger controls

✳ Why it matters: Business impact mapping is the lens that turns technical findings into business decisions. It’s how you get the CISO, CFO, and CEO speaking the same language—risk, in dollars, tied to outcomes they care about.

5. Control Effectiveness Testing

Purpose: Validate that your security controls are not just in place—but actually working under pressure.

It’s one thing to have a control on paper. It’s another to know that it consistently performs as intended in the face of real-world threats. As breaches continue to occur in environments that are fully "compliant," the industry is waking up to a hard truth: compliance ≠ security.

Control effectiveness testing answers a critical question:

“Are the safeguards we rely on—identity management, email filtering, encryption, logging—functioning correctly, consistently, and measurably?”

What this looks like in practice:

Control-to-risk mapping: Each identified threat scenario is linked to the specific controls designed to mitigate it, using frameworks like NIST CSF, ISO 27001, CIS Controls, or internal policies.

Design vs. operating effectiveness:

Design effectiveness ensures the control is theoretically appropriate for the threat (e.g., MFA exists for privileged access).

Operating effectiveness confirms the control functions in practice (e.g., MFA is enforced across all endpoints and generates alertable logs).

Three Lines of Defense approach:

Line 1: Business units and control owners

Line 2: Risk/compliance teams validating alignment with policies

Line 3: Internal audit or red/blue teams performing adversarial testing or formal assurance reviews

Example: Identity & Access Management (IAM) Control

Let’s revisit the SaaS payroll scenario. A critical risk involves an attacker exploiting a misconfigured IAM role in AWS to escalate privileges.

A mature organization would perform the following:

Design Review:

IAM policies are set with least privilege

Role assumption is tied to federated identity (e.g., Okta)

Operating Test:

Simulate access attempts using unused or misconfigured roles

Attempt lateral movement between roles with similar tags or permissions

Validate logs are generated and alerts are triggered in SIEM

Key Output

Control performance reports, showing pass/fail status, time-to-alert, time-to-containment

Residual risk register, identifying gaps where controls failed or were absent

Remediation roadmap, ranked by business impact and control criticality

Audit-ready evidence packages for internal, external, and regulatory review

✳ Why it matters: Controls are the scaffolding of your cybersecurity posture—but if they aren’t functioning as expected, the whole structure is vulnerable. Control effectiveness testing gives you proof—not assumptions—that your defenses hold under pressure.

Automation + Threat Intelligence: Accelerating Risk Maturity

As cyber risks scale in both complexity and frequency, one of the biggest barriers to maturity isn’t capability—it’s capacity. Risk and security teams are overwhelmed with assessments, evidence collection, third-party reviews, and regulatory mapping.

Automation is the force multiplier that unlocks continuous, scalable risk governance.

How Automation Enhances Risk Maturity

Increases assessment frequency: Instead of yearly or quarterly reviews, automation allows for monthly, even real-time updates—so risk decisions are made based on current conditions, not stale data.

Reduces manual effort: Automated control testing, evidence gathering, workflow tracking, and task reminders eliminate repetitive workloads.

Enables consistency across scale: Whether managing 30 assets or 3,000, automation ensures the same standard is applied and measured.

Tools Enabling Scalable Maturity

But here’s the critical insight:

Risk maturity doesn’t come from tools alone. It comes from how intelligently those tools are configured to reflect your business.

Automation must be paired with clear ownership, governance processes, and feedback loops. Otherwise, it’s just fast-tracking broken workflows.

Future-Proofing the Risk Assessment Program

Risk maturity isn’t a one-time goal—it’s a moving target. As technology evolves, so do the threats, the regulations, and the expectations.

Let’s explore three emerging forces that will shape how mature risk assessments evolve in the next 2–5 years:

1. AI-Augmented Risk Detection

Generative AI is already reshaping both the threat landscape and the risk detection toolkit.

On the threat side: Attackers are using AI for phishing email generation, credential stuffing scripts, and polymorphic malware that evades traditional detection.

On the defense side: Organizations are starting to deploy natural language processing (NLP) and AI models to:

Parse large volumes of vendor documentation

Analyze control performance logs

Detect patterns and anomalies in threat intelligence feeds

Forecast new risk scenarios before human analysts would spot them

Mature organizations are beginning to layer AI-based analytics into their existing SIEMs, risk engines, and even vendor due diligence workflows to improve speed and depth of detection.

2. Quantum Computing & Cryptographic Risk

Quantum computing isn’t science fiction—it’s approaching technical viability. And when it arrives at scale, it will render most traditional encryption (RSA, ECC) instantly obsolete.

NIST has already released post-quantum cryptography (PQC) standards such as CRYSTALS-Kyber and CRYSTALS-Dilithium.

Forward-leaning organizations are beginning to:

Inventory cryptographic assets used across applications and APIs

Identify vendors that will need to upgrade their crypto libraries

Establish governance to ensure timely migration as standards solidify

Post-quantum risk isn’t about reacting tomorrow—it’s about preparing today. Risk assessments need to evolve to include cryptographic asset risk profiling.

3. Geopolitical Risk & Cyber Sovereignty

From the war in Ukraine to China–Taiwan tensions and global supply chain disputes, geopolitical instability has become a cybersecurity risk multiplier.

Governments are mandating data localization, increasing risk for global SaaS providers.

Cyber sanctions and trade restrictions can instantly disrupt vendor access, licensing, or data flows.

State-sponsored actors now dominate major breach headlines—from ransomware to intellectual property theft.

Mature risk programs need to factor these realities into vendor selection, supply chain design, and regulatory exposure mapping. This includes:

Reviewing vendor dependencies in unstable regions

Identifying fourth-party suppliers or subcontractors

Consulting legal on cross-border data transfer liability

Practical Implementation Steps

Here’s how we build mature, business-aligned risk assessment programs:

Phase 1: Discovery

Map core business processes, critical systems, and data assets

Review existing risk registers, third-party inventories, and SLAs

Conduct maturity baseline assessment (people, process, tech)

Phase 2: Framework Design

Select a governance framework (e.g., NIST 800-30, ISO 27005, FAIR)

Define ownership for each risk domain (IT, third-party, legal, BCP)

Set up a continuous assessment calendar

Phase 3: Tooling & Integration

Implement or optimize GRC tools for automation and risk tracking

Align control testing with actual threat scenarios and KPIs

Build executive dashboards for ongoing risk communication

Phase 4: Simulation & Stress Testing

Conduct tabletop exercises using real threat scenarios

Leverage BAS tools for live simulations

Refine control maps and mitigation plans based on findings

Phase 5: Governance & Reporting

Establish risk steering committees with business leadership

Generate board-level reporting aligned to risk appetite and budget cycles

Schedule quarterly re-assessments and lessons-learned reviews

Final Thoughts: Risk Maturity is Strategic Maturity

At the highest level, a mature risk assessment program allows security and compliance leaders to:

Speak the language of the board: risk-adjusted ROI, financial exposure, business resilience

Drive smarter investments in controls, staffing, and automation

Embed security into core operations: DevOps, procurement, M&A, product development

Prove resilience through performance metrics tied to uptime, detection speed, and mitigation success

This is not just the future of cybersecurity governance—it’s the present.

Risk maturity is the bridge between today’s chaos and tomorrow’s resilience.

And that bridge is yours to build.

📚 References

Deloitte (2024). Future of Cyber Report

NIST SP 800-30 Rev. 1 – Guide for Conducting Risk Assessments

FAIR Institute – Factor Analysis of Information Risk

SEC Cybersecurity Disclosure Rules (2023–2024)

EU DORA Framework (2025 Enforcement)

MITRE ATT&CK Framework

NIST PQC Standards – https://www.nist.gov/pqcrypto